THE LAST RESOURCE YOU WILL NEED

Learn More. Save More.

We are here to help.

This is your hub for everything Montana registration.

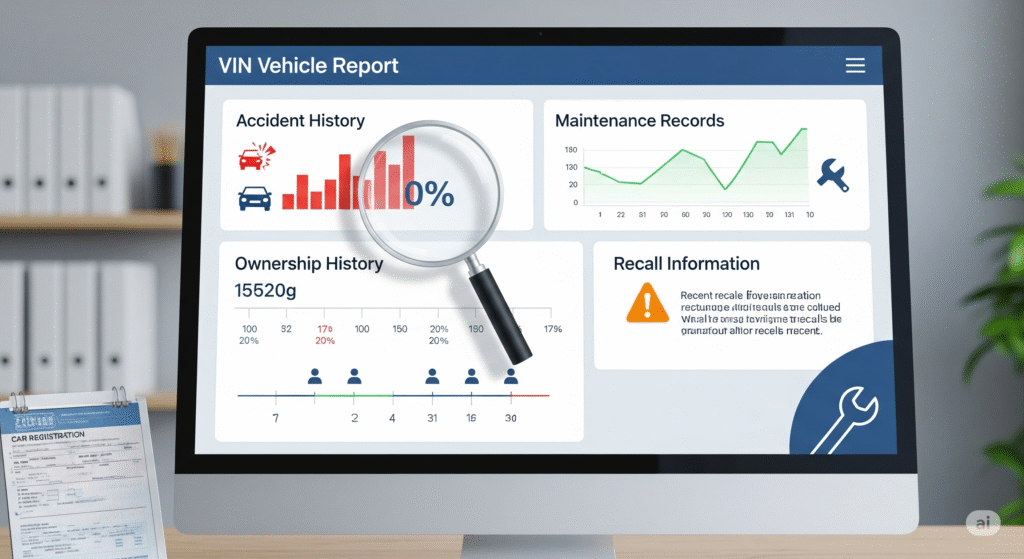

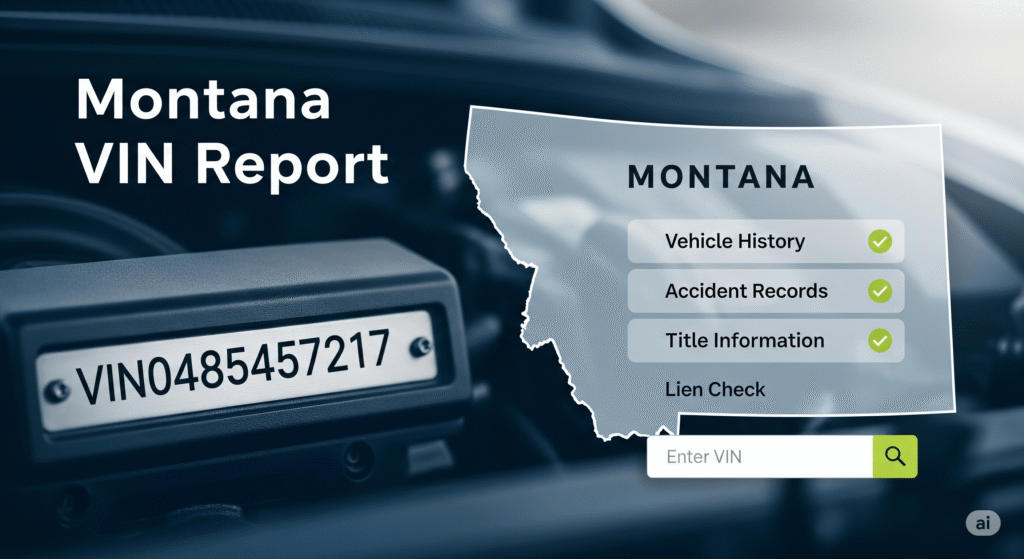

Whether you’re looking for insurance tips, a $1 LLC name search, VIN checks before buying a used vehicle, or just want to understand how the process really works—we’ve got you covered.

Browse trusted resources built to help you save money, stay legal, and register with confidence.

We Get It.

Registering your vehicle is a big deal.

We are here to help answer any questions you may have along the way so that you can hit the road with confidence.

Ready to Get Started?

LEARN MORE ABOUT MONTANA REGISTRATIONS

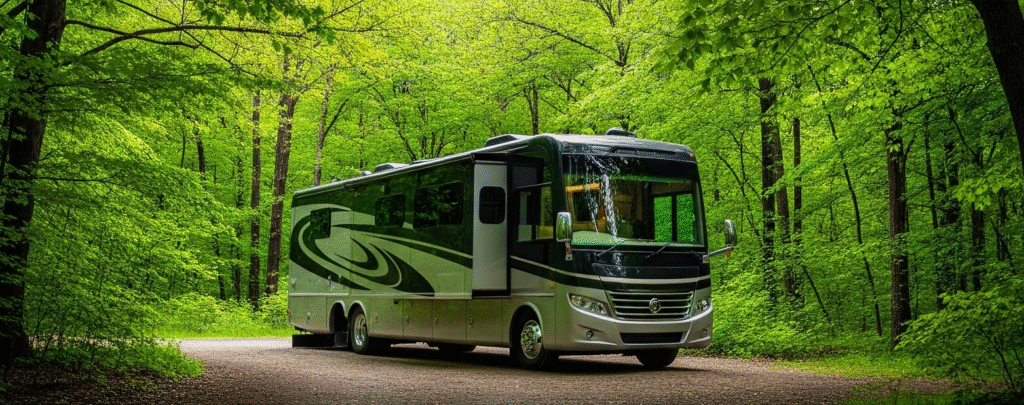

In Montana, a “light vehicle” typically refers to most everyday personal vehicles—cars, SUVs, pickup trucks (up to one ton), and vans. If it’s not a motorhome or a large commercial truck, it usually falls under this category.

So whether you’re driving a Nissan Frontier, Toyota Tundra, Ford F-150, Dodge Ram 2500, Ford Super Duty, or Chevy Silverado 3500, Montana considers it a light vehicle for registration purposes.

This is the technical term used by the Montana DMV—but for most drivers, it just means your car or truck qualifies for standard vehicle registration through your Montana LLC.

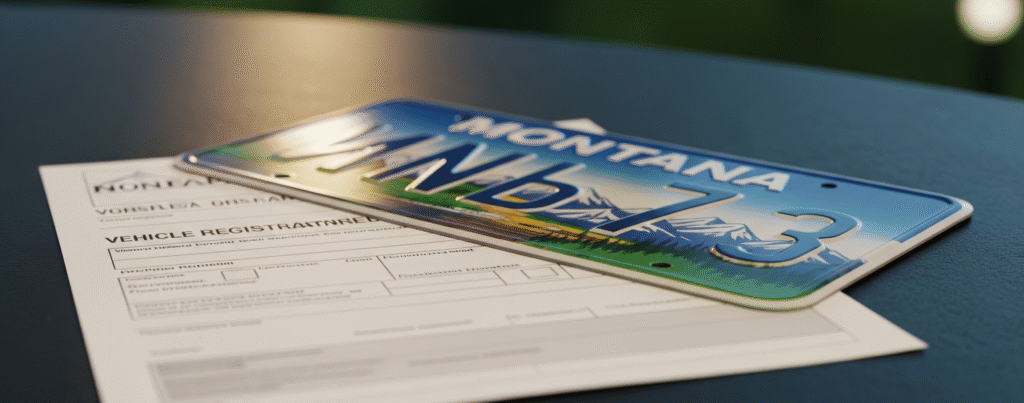

Yes — registering your vehicle in Montana through an LLC is completely legal and widely practiced. Montana law allows LLCs to own and register vehicles in the state, even if the owner lives elsewhere.

We follow the letter of the law and guide you through a fully compliant process used by thousands of out-of-state vehicle owners every year.

Montana charges 0% sales tax, which means serious savings—legally.

Let’s say you buy a $75,000 vehicle in a state with 7% sales tax… that’s $5,250 you’d normally owe just in taxes.

Register through a Montana LLC instead, and you skip that cost entirely.

That’s money back in your pocket for upgrades, adventures, or your next vehicle.

No—Montana doesn’t require emissions tests or routine vehicle inspections, making the registration process faster and easier than in states with strict environmental rules.

Yes—if your vehicle is 11 years or older and has a GVWR under 12,000 lbs, Montana allows permanent registration with a one-time fee. No annual renewals, no recurring costs—just register once and you’re set for life.

Yes! Sponsored plates are available for an additional $299. Just select the option during checkout when placing your vehicle order.

Yes, if your car or pickup had an original MSRP of $150,000 or more, Montana applies an $825 annual luxury tax until the vehicle is 11 years old.

That said, for high-value vehicles, skipping your state’s sales tax often saves you thousands more—making the Montana luxury tax a small price to pay in comparison.

When you register a new vehicle with us, you’re automatically enrolled in our renewal service. We’ll form your Montana LLC, provide registered agent service, and complete your initial registration. After that, our local team monitors deadlines and ensures your vehicle and LLC stay in good standing with the state.

When it’s time to renew, we handle everything for you—no stress, no missed deadlines. Once processed, your new tabs (and plates if needed) will be shipped directly to you.

Note: This renewal service applies only to standard light vehicles. It does not cover permanently registered vehicles, trailers, motorcycles, side-by-sides, scooters, boats, snowmobiles, or jet skis.

It depends on your lienholder. Some lenders allow title transfers to a Montana LLC, while others do not.

If there’s a lien on your vehicle, contact us before ordering and we’ll help you understand your options.

Most clients either update their current policy or get a new one written under their Montana LLC.

Let your insurer know where the vehicle is garaged and whether it’s your primary car.

If your insurer can’t help, we can connect you with agents who’ve worked with our clients before.

Absolutely. You can register additional vehicles anytime through your online portal.

Just follow these steps:

Log into your client account

Click on “Vehicle Registrations”

Select “+ Vehicle”

Submit your next registration in minutes

In Montana, vehicles must be registered in the county where your registered agent is located. Some counties charge an extra “county option tax”—but not ours.

We’re based in Whitefish, which does not have this added tax. That means lower registration costs for you, right from the start. It’s just one more way we help you maximize savings when you register with us.

Yes, but additional documents and steps may be required depending on how the vehicle was imported.

Reach out to us with details and we’ll walk you through what’s needed.