Summary

You formed or plan to form a Montana LLC. You want the title in the company’s name and you want insurance that pays without surprises. This page explains how to set up Montana LLC car insurance correctly, why garaging matters, how lenders and insurers think, what changes across states, and the simple steps to keep your file clean. You can do this yourself. If you want help, we partner with insurance professionals who speak this language every day and align your policy with your registration.

Official resources

- Montana minimum liability rules and insurance verification live at the Montana MVD. MT Motor Vehicle Division

- General insurance fundamentals and state-by-state requirements: Insurance Information Institute (III) and NAIC consumer pages. NAICIII

Talk to a specialist

Call 406-730-3000 or check out RegisterInMontana.com/Insurance. We’ll help point you in the right direction and connect you with our trusted partners. Once you have your insurnace questions sorted out, simply click below to get started!

The question everyone asks: “Will my claim get paid?”

Claims get paid when three things line up:

- The owner on title matches the named insured (or the policy uses an acceptable endorsement).

- The garaging address on the policy matches where the car actually lives most nights.

- The drivers and usage listed on the policy match reality.

If those are true, your Montana LLC car insurance functions as intended across state lines. If any of those are false, you create grounds for delays, canceled policies, or denials based on misrepresentation. Insurers price policies using where the car is kept and who drives it; misstating those items is a well-known problem across the industry. III+1

First principles: liability limits and Montana’s baseline

Montana requires proof of financial responsibility. The typical minimum liability limits you’ll see are 25/50/20 (per-person, per-accident bodily injury, and property damage). Most owners choose higher limits, but knowing the floor helps you compare quotes apples to apples. The MVD publishes the minimums and the verification process. MT Motor Vehicle Division

Your Montana LLC car insurance will also travel with you. When you drive into another state, most policies automatically adjust to meet that state’s minimum liability requirement through an “out-of-state” or “broadening” clause. You don’t buy a second policy just to cross a border for a road trip; your policy adapts to the state you’re in for minimums. Bankrate

Business title means business insurance (or the right endorsement)

If the vehicle is owned by a business, a standard personal auto policy usually does not provide coverage for that vehicle. The general rule from the Insurance Information Institute is clear: vehicles owned by a business need a commercial auto policy (or a carrier-approved structure). For some use cases, certain carriers may allow a personal policy with a specific endorsement and the LLC listed appropriately, but that is carrier-specific and not the default. This is where our insurance partners earn their keep. III

How we approach it

- Title in the LLC name.

- Policy that lists the LLC as the named insured (or uses the correct business endorsement).

- All regular drivers disclosed.

- Lender and lienholder listed exactly as required.

Aligned documents are the quiet foundation of Montana LLC car insurance that pays when it matters.

Garaging: the most important line on your application

Insurers rate your policy on where the vehicle is primarily kept. Garaging drives risk: theft patterns, crash frequency, repair costs, weather, and legal environments all vary by location. List where the car actually sleeps. If you live in another state and keep the car there, the policy should reflect that location. That is normal and lawful; it’s how insurers price risk. Misstating garaging is considered misrepresentation and can support claim denial or policy cancellation. III+1

Plain talk

There is nothing inherently illegal about titling a vehicle to a Montana LLC and insuring it. Problems arise when someone lies about facts like where the car lives or who drives it. Keep the story true and your Montana LLC car insurance behaves like any other policy.

Out of state, across borders, and the “one policy” rule

You do not need multiple auto policies just because the title sits in Montana. The carrier wants to know where the vehicle is kept most nights. In most cases you maintain one policy rated at the real garaging location, and it is valid wherever you drive in the U.S. The insurer may require a different state version of the policy if you move the car permanently to a new state. This multi-state guidance is published by major carriers and consumer resources. ProgressiveBankrate

Translation

- Weekend trip? Your policy travels.

- Seasonal move? Update the policy.

- Permanent move? Rewrite the policy for the new state.

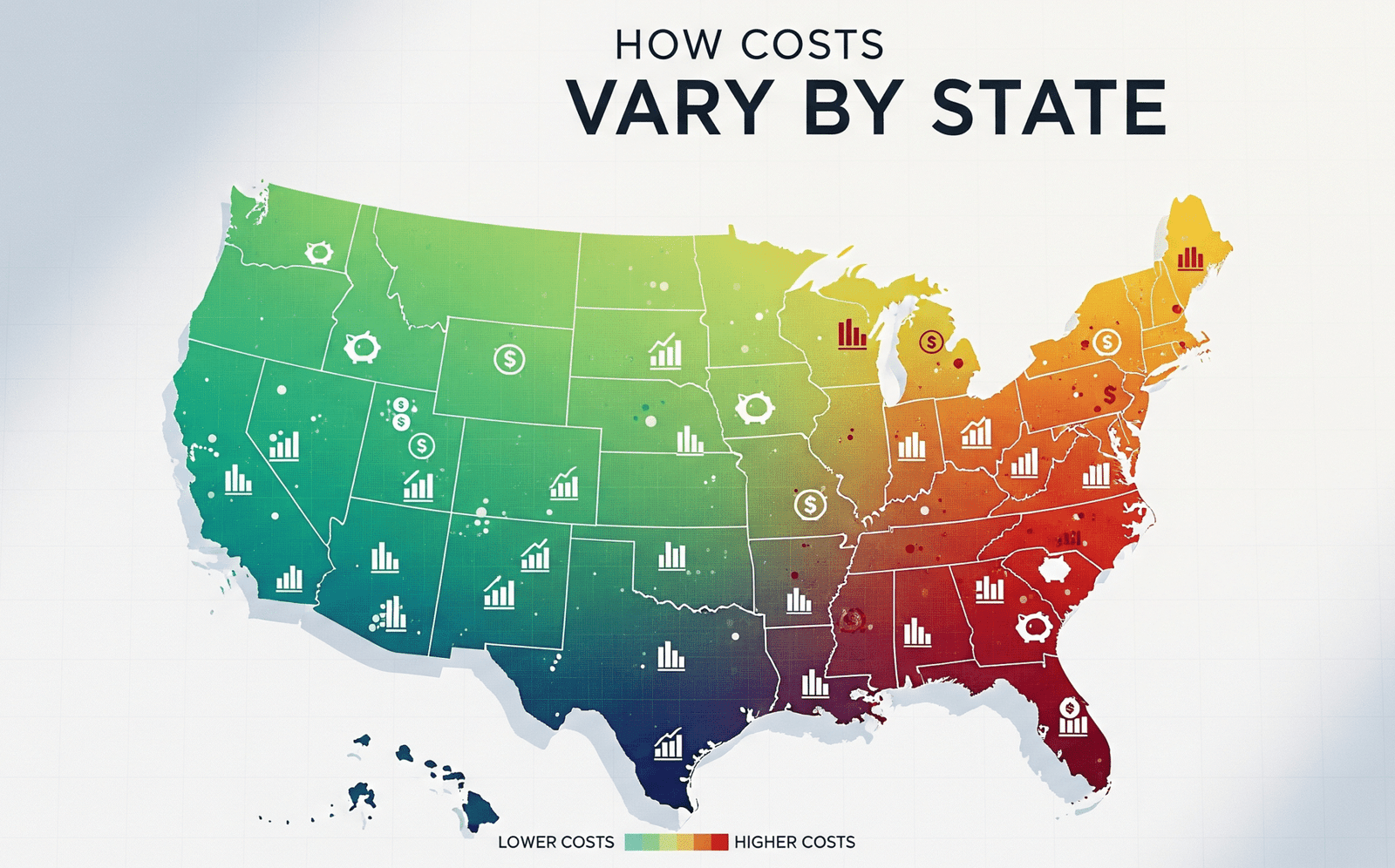

How costs vary by state

Two identical cars and drivers can see very different premiums because states differ on litigation trends, medical and repair costs, fraud rates, extreme weather, and local laws. That is why Florida, Louisiana, and Michigan regularly rank among the least affordable states, while places like Iowa are often cheaper. If you garage in a high-cost state, expect that reality to be priced in. III+1

This is also why working with a pro matters. Our partners quote Montana LLC car insurance with the right garaging location and can explain why two states price the risk differently.

Lenders, lienholders, and proof for funding

If you are financing the vehicle, your lender will want the entity documents (Articles and Operating Agreement), possibly a one-page resolution authorizing the purchase, and insurance that names the LLC and lists the lienholder correctly. Small typos in the lienholder address or entity name are common reject points. A tidy package closes funding on schedule. We coordinate the names and send the exact lines your lender expects.

Personal vs commercial use: Where owners get tripped up

- Personal use only, LLC on title. Ask your carrier how they handle an LLC-owned vehicle used personally. Some will write a commercial policy with personal use. Some allow an endorsement on a personal policy when the LLC is just a holding company. This is case-by-case. III

- Business use. If the vehicle is used in business operations, you are usually in commercial territory. The safe default is to match title and policy type. III

Your agent’s job is to place you correctly. Our job is to make sure the names, addresses, and uses we give them are accurate so your Montana LLC car insurance quote matches the real world.

A short story from the field

An owner kept a weekend car at home out of state, titled to a Montana LLC. We aligned the dealer’s buyer line, prepared the one-page resolution, and connected the owner to a partner agent. The agent issued a policy with the LLC named as insured, drivers listed, and the home garaging address. The lender was listed as lienholder; the binder matched the title application. The packet sailed through. Weeks later a small hail claim paid quickly because every fact matched the file. That is the result we build toward.

How our partners help (and what we don’t do)

We are not insurance agents and we do not sell or service policies. We do three things well:

- We set clean expectations before you buy.

- We make sure your entity and title details match your intended policy.

- We introduce you to insurance partners who know how to place Montana LLC car insurance with truthful garaging and the proper named insured.

Your agent then does the agent work: coverage advice, carrier selection, endorsements, and billing.

What to tell your agent (copy this)

Use this when you call:

“Title will be in my Montana LLC. I will garage the vehicle in [city, state]. I want the LLC as the named insured and all regular drivers listed. I need the lienholder shown as [lender] at [address]. Please confirm whether this is a commercial auto policy or a personal policy with the correct endorsement for an LLC-owned vehicle. Send a binder and ID cards once bound.”

That script gives your agent everything they need to quote Montana LLC car insurance correctly on the first pass.

Common mistakes and how to fix them

- Wrong named insured. If title is in the LLC and your personal name is the named insured, fix it. Ask your agent to reissue with the LLC as named insured or place the correct policy type. III

- Garaging mismatch. Policy shows Montana while the car lives at home in another state. Correct the garaging address and re-rate. Misrepresentation can cost you coverage. III

- Missing drivers. Add household drivers who regularly operate the vehicle.

- Lienholder line wrong. Ask your lender for the exact wording and address; update the policy and title application.

- State minimums only. Consider higher limits; minimums rarely cover real losses. III

Quick math: Why quotes jump when garaging changes

If you move a car from a low-cost rural ZIP to a dense urban area with higher crash frequency and repair costs, the price changes. Insurers factor local litigation, medical costs, fraud, theft, and weather. That is normal. The job is not to “game” the system. The job is to tell the truth and buy coverage that fits how you actually use the car. III

What about out-of-state driving all year?

Your policy follows you around the U.S. and broadens to meet higher state minimums when you cross borders. If you permanently relocate where the vehicle lives, rewrite the policy for the new state. Our partners will guide you; the rule of thumb is to rate the car where it sleeps. BankrateProgressive

FAQs

Is it legal to insure a Montana-titled LLC vehicle if I live elsewhere?

Yes, when facts are truthful. Title in a real LLC, policy with the LLC as named insured (or correct endorsement), real garaging address, and listed drivers. Problems come from misstatements, not from the company structure itself. III+1

Do I need a commercial auto policy?

Often yes if the vehicle is owned by the LLC. Some carriers handle a holding-company LLC with endorsements. Your agent will place you correctly; our partners do this every day. III

What are Montana’s minimums?

Commonly 25/50/20 for liability. Many owners buy higher limits. See the Montana MVD page for details. MT Motor Vehicle Division

Will my coverage work in other states?

Yes for normal travel. Most policies adjust to meet another state’s minimums when you drive there. Permanent moves require updating or rewriting the policy for the new state. Bankrate

Why is my premium higher than my friend’s?

States price risk differently based on litigation, medical and repair costs, fraud, and weather. Garaging location and driver mix matter. III

Why we partnered with these insurance pros

We hear the same questions every week. We partnered with agents who know Montana LLC car insurance placement cold. They build policies that match your entity, your garaging, your drivers, and your lender. That is how you get a binder that funds the deal and a policy that pays claims.

Next step

Simply click the button to get started

Still have questions? Call 406-730-3000 or email support@zerotaxtags.com. Tell us your state, your vehicle, and where the car sleeps. We’ll map the plan and connect you with the right partner.