MONTANA VEHICLE LLC

Goodbye DMV.

Hello Montana LLC!

No sales tax. No smog checks. No hassle.

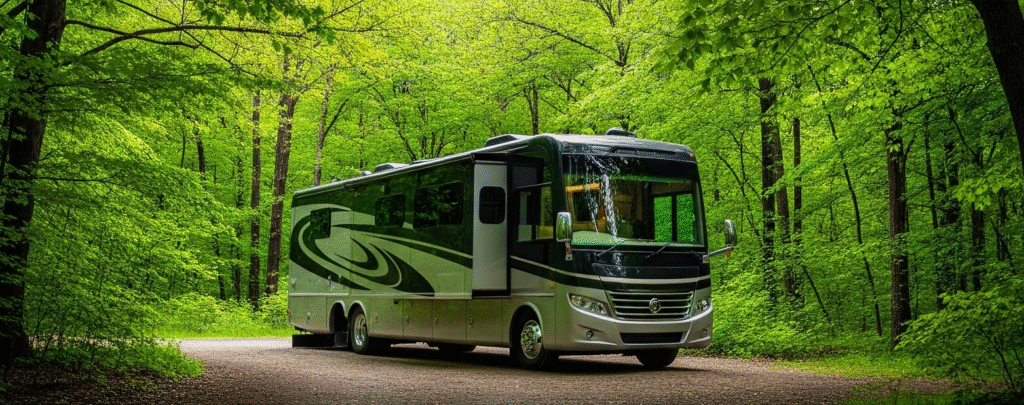

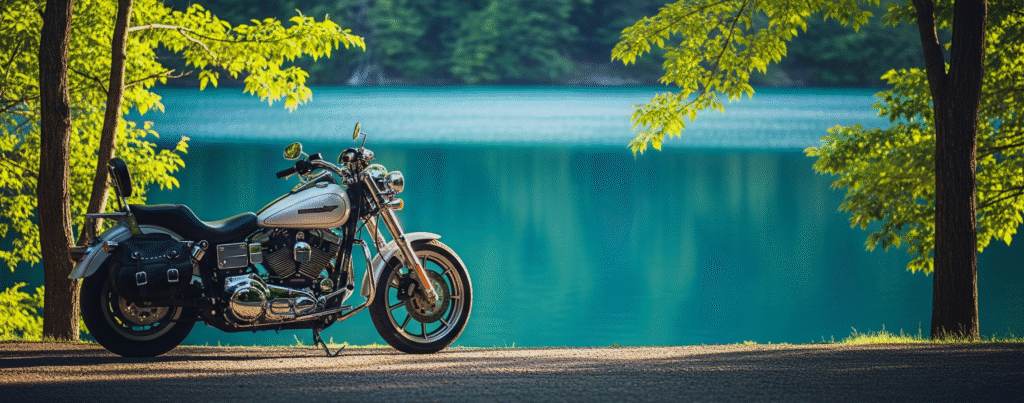

Forming a Montana LLC lets you title and register your vehicle in Montana—legally and completely online—even if you don’t live there. This setup works for nearly every vehicle: cars, pickups, RVs, motorcycles, trailers, side-by-sides, boats, and more.

With the help of Zero Tax Tags, we’ve made it easy and affordable to take advantage of Montana’s 0% vehicle sales tax and no inspection requirements.

We’ll have your LLC filed within 1 business day.

What in the world is a Montana Vehicle LLC?

A Montana Vehicle LLC is a simple legal structure that allows you to register and title vehicles in Montana—even if you live out of state. Since Montana doesn’t charge sales tax and doesn’t require emissions testing or inspections, this setup lets you buy vehicles tax-free and skip the red tape common in other states.

- Save thousands of dollars in unnecessary sales tax

- Never worry about unexpected inspections or compliance issues again

- Skip the long, frustrating lines at the DMV

Here’s how it works: You form a Montana LLC, which is treated as a legal resident of the state. The LLC becomes the registered owner of your vehicle—whether it’s a car, truck, motorcycle, RV, or even an off-road vehicle like a UTV or side-by-side. Because the vehicle is owned by a Montana company, you can register it with Montana plates and avoid your home state’s taxes and restrictions.

We make the whole process fast and stress-free by handling everything from LLC formation to vehicle registration, so you don’t have to lift a finger.

Why So Many Out-of-State Drivers Choose Montana

Montana’s vehicle registration laws offer benefits you won’t find in most states—and savvy buyers are taking advantage:

No Sales or Property Tax

Save thousands upfront—Montana skips the taxes that other states tack on.

No Emissions Testing

Worried about smog checks or EV loopholes? Montana doesn’t require any of it.

No Vehicle Inspections

Forget the long lines and red tape—Montana makes it simple to register and drive.

Permanent Registration

Qualifying vehicles can be permanently registered with a single payment—no renewals, ever.

It’s really simple: With Montana plates, you’re getting more freedom for less money.

The Zero Tax Tags Vehicle LLC Registration Process – Simple, Legal, Done For You

Setting up a Montana LLC for vehicle registration doesn’t have to be confusing or expensive. Our partners Zero Tax Tags handles everything from start to finish for one flat fee—starting at just $275. No surprise costs. No runaround.

Sign Up Online

Get started in minutes with our secure online sign-up.We Form Your LLC

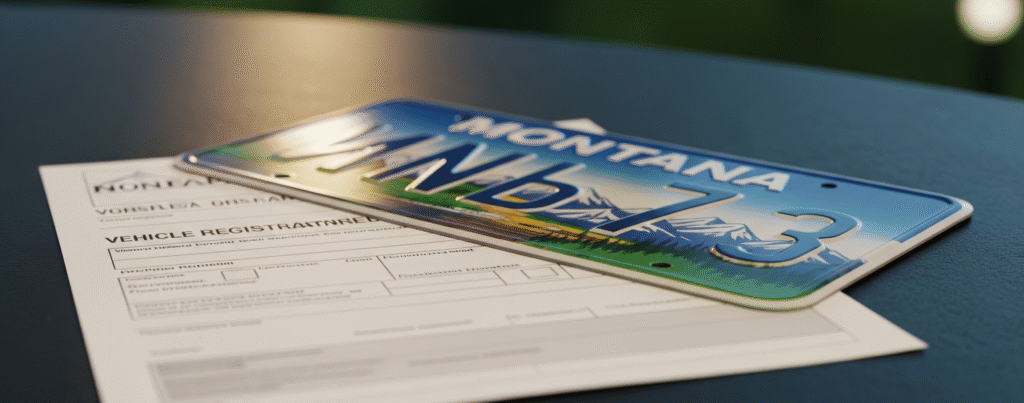

We immediately create your Montana LLC and provide a real business address with anonymous filing options.Buy Your Vehicle

When you purchase the vehicle, title it in your Montana LLC’s name (not your personal name).Send Us the Paperwork

You (or your dealer) send us the title or MSO along with a simple cover sheet we provide.

Once Zero Tax Tags receives your documents, our local team takes it from there—filing all forms with the Montana DMV and handling every detail. As soon as registration is complete, we ship your plates and registration documents directly to your door.

HOW MUCH WILL THIS COST ME?

Full-Service Montana Registration — Just $999 Total

Our all-inclusive price covers everything you need to register your vehicle in Montana under an LLC. That means:

Montana LLC formation

Registered agent service

All state and DMV fees

Priority shipping

No hidden fees. No upsells. No nonsense.

Here’s the breakdown:

| Service | Price |

| Montana Vehicle LLC | $200 |

| 1 Year of Registered Agent Service | $100 |

| LLC Annual Report Filing | $45 |

| Vehicle Title and Registration | $699 |

| Custom Plate: Background (OR) Lettering | $150 |

| Custom Plate: Background (AND) Lettering | $275 |

| Temporary Tag (40 Days) | $725 |

* Additional state and processing fees will apply annually in the following scenarios:

Luxury Vehicle Tax

- Applies to the following vehicles under 11 years old

- Light vehicles (MSRP ≥ $150,000): $825 luxury tax

- Motorhomes/RVs (MSRP ≥ $300,000): $800 luxury tax

Electric/Hybrid Vehicle Tax

- Light hybrid vehicles (Toyota Prius): $70+

- Class 1 Electric Vehicles (Tesla Model S): $130

- Class 2 Electric Vehicles (Cybertruck): $190

- Class 3 and 4 Electric Vehicles: Call us

Heavy Vehicle Weight Fees

- Trucks/Buses with 1 Ton ratings or higher (a GVWR of 12,000 lbs or higher)

- Fees vary based on the age and weight of the vehicle.

- Please call for a quote.

Why Choose Us for Your Montana Vehicle LLC?

We’re not just a registered agent—we’re Montana vehicle LLC specialists. Our team files LLCs and vehicle registrations every single day.

This isn’t about cutting corners—it’s about making informed decisions. With over 20 years of experience and more than 100,000 successful registrations, we’ve helped clients save $5,000 to $15,000+, all while staying fully compliant with state law

You could go with a big-name online formation service that doesn’t know Montana law… or pay an attorney thousands just to get started.

Or—you can let us take care of everything for one affordable flat rate and get all of this:

We handle all the paperwork and file your Montana LLC formation within 24 hours—no confusing forms, no wasted time. Just a smooth start with everything done right.

Your name won’t appear in public records. We list our name and address instead, protecting your personal info from search engines, solicitors, or potential lawsuits.

We auto-enroll qualifying new vehicles into our renewal system so you don’t have to lift a finger next year. Fewer moving parts means your data stays safer, and your registration stays current.

We include annual report reminders and an optional filing service ($45 + state fee), so your LLC stays in good standing year after year. Prefer to handle it yourself? You can opt out anytime in your account.

Most Montana counties charge extra taxes. Ours doesn’t. We’re based in Flathead County, which means more savings for you—automatically.

Skip the hype and marketing fluff. We’ve built a reliable client portal that lets you manage your LLC, renew registrations, track vehicles, and access documents 24/7.

We’re not new here. With years of experience and thousands of successful vehicle registrations behind us, we know how to get it done right—fast, legally, and affordably.

What you see is what you pay. No surprise fees, no upsells disguised as “extras,” and no shady fine print. Just fair, honest pricing from day one.

MONTANA VEHICLE LLC FAQS

Montana doesn’t charge sales tax on vehicle purchases—that’s true for both residents and businesses. But here’s the catch: if you register the vehicle in your home state, you’ll likely get hit with registration fees, taxes, and other costs.

That’s where a Montana LLC makes all the difference.

Montana treats LLCs as legal residents, which means your Montana business can own and register vehicles—without you needing to move, get a Montana license, or become a resident. When you buy a vehicle using your Montana LLC, you’re legally using the state’s no-tax benefit while avoiding the headaches and costs of registering back home.

It’s a smart, legal workaround that’s helped thousands of vehicle owners save thousands in taxes and fees.

Possibly—if your vehicle meets certain criteria based on its original MSRP and age. Here’s how it breaks down:

Light Vehicles (cars and pickups): If the vehicle had an original MSRP of $150,000 or more, you’ll owe $825/year until it turns 11 years old.

Motorhomes & RVs: If the MSRP was $300,000 or more, expect an $800/year luxury tax until it reaches the 11-year mark.

After that, these taxes go away—and you’re eligible for permanent registration with no renewals.

Yes, it’s an extra fee. But when compared to sales tax in places like California, Illinois, or Florida, Montana’s luxury tax is often a fraction of the cost. You’ll still come out ahead.

Once you’ve formed your Montana LLC, you’ll purchase the vehicle as usual, except that you’ll list your Montana LLC—not you, the human—as the owner on the title paperwork.

Thanks to our streamlined process and direct access to local DMV resources, we can typically ship plates and registration in as little as 3 business days.

We move faster than out-of-state services or law firms because we’re built specifically for this.

Most clients either update their current policy or get a new one written under their Montana LLC.

Let your insurer know where the vehicle is garaged and whether it’s your primary car.

If your insurer can’t help, we can connect you with agents who’ve worked with our clients before.

Yes! Sponsored plates are available for an additional $299. Just select the option during checkout when placing your vehicle order.

Absolutely. You can register additional vehicles anytime through your online portal.

Just follow these steps:

Log into your client account

Click on “Vehicle Registrations”

Select “+ Vehicle”

Submit your next registration in minutes

You’ll continue to have access to your secure client portal, digital mail forwarding, and optional services like transfers, renewals, and additional vehicle registrations.

We’re not a one-time service—we’re here to help as long as you need us.

It depends on the vehicle:

Cars & trucks with MSRP $150,000+ = $825/year

RVs with MSRP $300,000+ = $800/year

These fees apply until the vehicle is 11 years old.

Even with this tax, Montana registration typically saves tens of thousands vs. paying sales tax in states like California, New York, New Jersey, Texas, or Florida.

No. We register vehicles through Flathead County (Whitefish), which does not charge a county option tax.

Other services based in different counties may cost you hundreds more due to this added fee.

It depends on your lienholder. Some lenders allow title transfers to a Montana LLC, while others do not.

If there’s a lien on your vehicle, contact us before ordering and we’ll help you understand your options.

Yes, but additional documents and steps may be required depending on how the vehicle was imported.

Reach out to us with details and we’ll walk you through what’s needed.

Yes. All Montana LLCs must file an annual report by April 15 to stay in good standing.

Miss it, and the state adds a $15 late fee—or may dissolve your LLC altogether.

We include free reminders through your portal and offer optional filing assistance for $45 + state fee. You can manage or cancel this service anytime.